Rocket’s Krishna: We’re Going to do Right by Brokers

Rocket has a new wholesale strategy. We’ve got the details.

Over the years, Rocket 🚀 hasn’t always been the best partner to brokers. But the Rocket of ‘25 is different, CEO Varun Krishna said at the company’s flagship broker event Tuesday. And to help convince them, Rocket tapped the power of their marketing engine & tech platform.

The lender announced a bunch of different new products & initiatives at Rocket Pro Experience. Let’s break it down (plus a scoop on what they’re doing w/ distributed retail).

Some highlights:

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)

What's On Tap - Sept. 30

Rocket Pro (Cont.)

A 10-point credo that emphasizes it’s 100% the broker’s choice whom he/she works with, full pricing transparency, never taking clients & helping brokers grow their business.

Rocket has also shifted its marketing away from ha-ha ads to more emotional narratives (and all feature that John Denver 🏔️ song, I guess?). For the first time, Rocket is rolling out a dedicated national TV campaign featuring broker partners.

They also went live with BrokerNearMe.com, a consumer-facing site that connects borrowers w/ their local brokers, as well as Rocket Pro Assist, a chatbot that answers nearly all questions a broker might have.

But the biggest rollout is Rocket Pro Navigate, a ChatGPT LLM that functions as a virtual workstation for mortgage brokers. It has roleplay & coaching, lead gen, document analyzer capabilities & client notes. Rocket Pro Navigate can be used w/ a broker’s total pipeline – not just Rocket loans.

"We started releasing it with partners in beta over the last 2 months," Rocket Pro GM Dan Sogorka told me. "You walk into somebody's office & drop in your list of past closed clients for the past 2 years & it immediately goes through the list of who's in the money, how much, what's the strategy."

That speaks to the broader wholesale strategy. Rocket in some ways is still haunted by the ghosts of Wholesale Past. But the mantra appears to be: Take the high road, provide useful tools & services for brokers & help them grow their business.

The company’s leadership bench looks different these days. Sogorka & Katie Sweeney are now at the helm. The company also is now on the ARIVE platform, which alone should help them win business.

Broker attendees who spoke with The Scoop also said they believed UWM’s “Ultimatum” has lost some of its bite, in part because Rocket has been consistent in its support of brokers over the past few years. And w/ a $1B marketing budget, Rocket has the firepower to put mortgage brokers in front of consumers in a way that could build both trust & volume.

Still, skepticism lingers. UWM remains dominant w/ roughly 50% market share. And the fundamental math hasn’t changed—margins are slimmer in wholesale, which raises the question of whether Rocket will stick by brokers when profits are on the line. While the company is eager to position itself as championing the broker channel, details remain scarce on how many leads from Redfin or Mr. Cooper will flow to brokers vs being funneled elsewhere inside Rocket. (See our reporting from last week.)

Sources told The Scoop that Rocket is also getting more aggressive w/ its other key purchase play — Rocket Local. One retail LO in California said a recruiter on Friday offered him 115 bps on self gen business & 80 bps on Redfin deals. “We are looking for loan officers who want to partner w/ our agents. We can add deals to your pipeline!” the recruiter’s text read.

“It’s a compelling offer,” the LO told me.

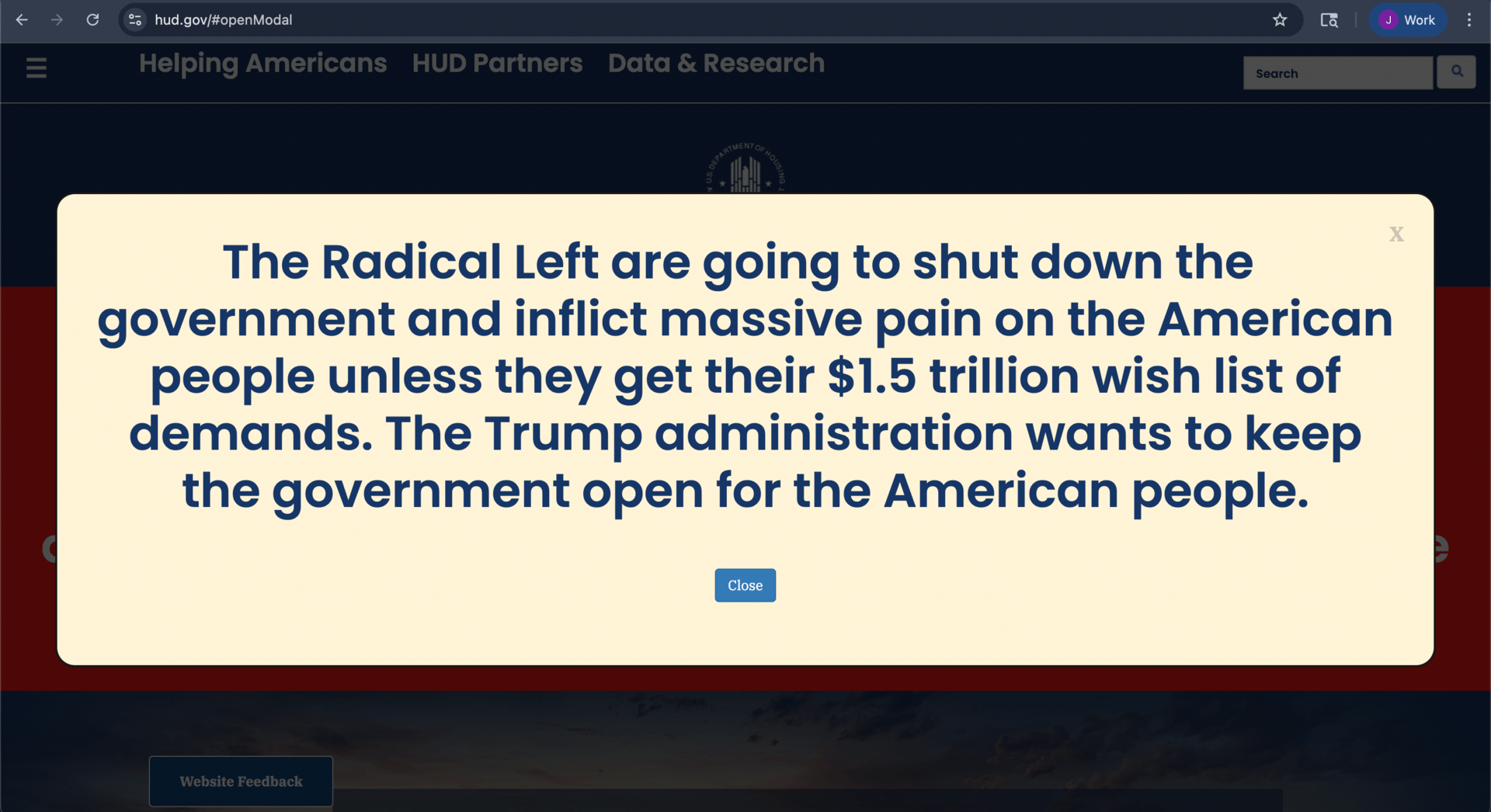

HUD’s Website… 🙄

Have you checked out the HUD website today? Oh boy. Here’s what it looks like.

I can confirm that HUD was not hacked, this is 100% intentional. Elsewhere on the HUD website, all kinds of links to important services & information are broken, so priorities, I guess? Anyway, if an agreement can’t be reached, the gov’t shutdown will affect borrowers. There will be funding issues w/ the NFIP and delays w/ employment verifications, SS validations, tax transcript verifications, etc.

Vendor Canary in the Coal Mine 🪶 ?

News of Aidium’s rescue may just be the tip of the iceberg, several sources told The Scoop. “I think we’re about to see a lot of vendors disappear next year,” said one industry consultant w/ a large number of vendor clients. A couple people have told me there’s been a rise in unpaid invoices & deal talks as financial runways end.

But a different tech source disagreed that there will be a mass vendor extinction event. “Some definitely will, but a lot I don’t agree with,” he said.

Although lender budgets are up for the 2026 sales year, it’s nothing like the glory days of ‘20, ‘21 & some lenders are opting to build products in-house or acquire vendors. Worth watching.

The CCM Playbook 🏈

CrossCountry Mortgage is carving out a very unique path🚶♂️so it doesn't live and die by the rates game & servicing hedges, argues Coby Hakalir.

“Its asset management arm CrossCountry Capital is a $7B non-agency platform w/ $20B+ in lending capacity. By raising outside investor capital, CCM earns management fees & securitization income even when origination slows. That's a revenue stream most IMBs don't have...With 50+ investors in their securitization program, they’ve built capital markets optionality that gives them structural advantages over pure retail shops. The result: CrossCountry is building an asset management moat—a fundamentally different model that earns money across rate cycles."

One rival said Coby’s dead on the money, but he is still a smidge nervous for Ron Leonhardt & Co. w/ the non-QM play.

“I love what CCM is doing,” the source said. “I’m a little concerned about how much they’re going in on non-QM & what types of exceptions on their own loans. They don't have to worry about selling it to an aggregator, but ⅓ goes to the exceptions desk.”

Other IMBs might try to imitate CCM w/ having an asset management arm w/ outside investor capital, he said. But that’s tough to pull off.

CCM is unique in other ways too. Executives that left CCM for other mortgage companies are bringing the CCM playbook to their new shops, a retail banking source added. Let sales managers duke it out for talent, be ambivalent about territory.

“You have 5 branches in the same area that all compete w/ each other. I don't think that model works for everyone. Do we teach that at business school because it worked for Ron Leonhardt?" he asked.

Redfin-Zillow Hit With AntiTrust Suit 👮

ICYMI: Rocket & Zillow are being sued for $100M by the FTC. Redfin & Zillow allegedly signed an illegal agreement to suppress rental advertising competition in Feb. ‘25. “Paying off a competitor to stop competing against you is a violation of federal antitrust laws,” said the FTC’s Daniel Guarnera. “Zillow paid millions of dollars to eliminate Redfin as an independent competitor in an already concentrated advertising market—one that’s critical for renters, property managers, and the health of the overall U.S. housing market.”

Quickies

What an absolute mess the Appraisal Institute is. According to Bisnow, the person in charge of approving professional designations hasn’t held a valid appraisal license since ‘18.

loanDepot’s marketing whiz Alec Hanson is now overseeing production on the West Coast.

Better announced a new HELOC product that allows borrowers to qualify w/ bank statements. Better could have funded HELOCs for 6,000 applicants they denied last year w/ the new product, the digital lender said.

Rents in the top 20 U.S. markets for single-family homes are expected to rise 0.8% this year, per John Burns Research & Consulting. That would be the slowest pace since ‘11.

The Scoop broke the WILQO-Brimma news yesterday. But wait, there’s more: Sources say WILQO will have hundreds, maybe thousands of live loans by the time the calendar turns to ‘26.

Navy Federal ⛵ just inked a new deal with Dark Matter Technologies. But sources tell The Scoop that loanDepot is looking at leaving Empower…

ARMchair Critics

Programming Note: We’ll publish next on Friday. Our schedule should be back to normal next week!

🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.