Born out of one of the world’s leading AI research labs, Friday Harbor was built to handle the complexity of real-world lending in ways most mortgage tech can’t duplicate. Visit fridayharbor.ai for a demo.

UWM said it locked $4.8B in a single day w/ minimal disruptions. Once they combine in-house servicing in ‘26 w/ AI chatbot Mia (which helped close 14K loans), watch out…

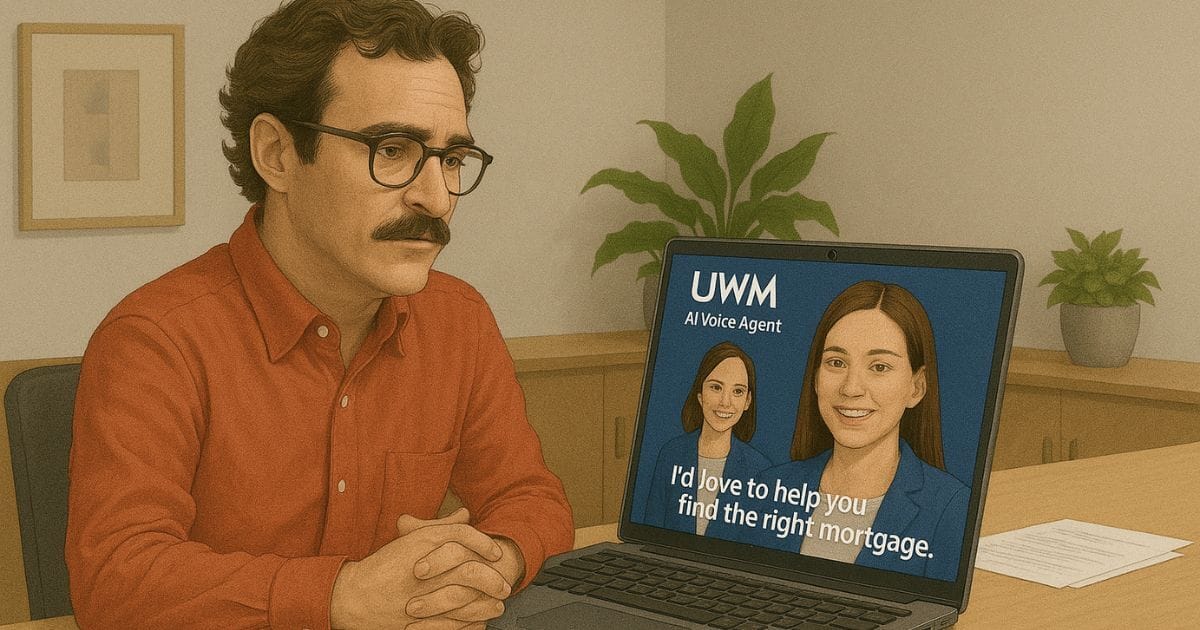

Forget Buying Servicing Books—UWM’s Edge Might Be an AI Named Mia 🤖

At UWM Live in May, Mat Ishbia walked onto the stage & introduced his billion-dollar girl 💃to 6,000 broker partners. “Mia” is the company’s generative AI voice 📞assistant tasked w/ making UWM’s army of broker clients more competitive.

Mia solves a lot of the scale ⚖️challenges in the broker space. She calls clients proactively when they’re in the money, answers questions & schedules conversations. Mia is a hard worker, too—since the launch in late spring, Mia has made 400K outbound calls & helped UWM close 14K loans. Mia had a hand in UWM locking $4.8B in a single day in September, a truly astounding number that is only possible when extreme load flow meets operational excellence.

For the first time, we’ve got real numbers to dig into on the wholesale lender’s big bets in tech & servicing. Let’s break it down.

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)

What's On Tap - Nov. 7

UWM (Cont.)

Mat Ishbia said on Thursday’s earnings call that 95% of Mia’s 400K outbound calls were of the “rate watch” variety. Though the lender predicted that consumers would answer Mia roughly 10-15% of the time, consumers actually picked up 40% of the time. The 14,000 closings comes out to 3.5% conversion rate ‼ That's very high—LOs at call centers would be chuffed w/ 1%. It dovetails right into UWM’s other massive investment: servicing.

There's been intrigue about how UWM would compete w/ Rocket once its arch-rival fully operationalizes its $44B servicing-real estate-origination doomsday machine. He doesn’t seem perturbed that Rocket touches 1 in 5 mortgages. In fact, Ishbia intimated that Rocket made the wrong play.

“People say that if you own the servicing book, you get the refi. That ain't the game anymore, although people are spending billions & billions buying servicing books. It helps, it gives you an inside track. But it's not driving it.”

Ishbia noted on the call that even though UWM’s servicing book was just 2% of the market last quarter, they did over 11% of the refis.

He’s spending upwards of $100M to take servicing in-house (w/ MSP). Starting in ‘26, UWM is going to self-service all loans they originate. They’ll port over all the loans being subserviced by Cenlar over the course of ‘26 (w/ the exception of some defaults) & pair it w/ Bilt Rewards, a consumer-friendly play that is pretty unique. That should give Mia—and her LOs—millions of opportunities & position UWM to do huge volume in ‘27 & beyond.

“We're going to be better than every other servicer out there b/c we're better than everyone at everything we do & servicing is a joke in our industry,” Ishbia said. “We're going to make it really great for the client. When people call, we're going to actually answer the phone, not 43 minute waiting periods like everybody else does.”

Mia has already proven valuable on refi opportunities & the tech is undoubtedly impressive. Ishbia told analysts that UWM’s AI tech is 3-5 years 🫢 ahead of competitors, but it still remains to be seen whether Mia can make a similar impact on purchase (which, to be fair, UWM is historically good at). What happens if regulators/courts put guardrails on calling 400K+ people a quarter w/ AI dialers? Either way, Ishbia is right: The game 🏀 has changed.

🍦 Important News About The Scoop 🍦

Hey, everybody! The Mortgage Scoop launched about 2 months ago & I’ve been blown away by the support. Thank you 🙏 so much. I wanted to share an important update about the business. We’ll be moving to a paywall starting Wednesday, Nov. 19.

Paid subscribers will get exclusive MWF newsletters packed with scoops, analysis & insights you won’t find anywhere else (plus some bonus content). Founding Members can lock in the price of $240 per year. Monday editions will remain free & open for all subscribers. Hit me up w/ any questions you might have. - James Kleimann

A Very Fun Theory About the New DU Change 😜

Fannie on Wednesday made a big change & it’s producing some fascinating 🥸 industry intrigue. Starting on Nov. 15, there will no longer be a minimum credit score for DU (it was previously 620). Instead, Fannie is looking solely at the credit profile using its proprietary risk-model.

Now, I would say there are probably a handful of cases where a borrower w/ a credit score of 620 or lower results in AUS approval, so maybe we shouldn’t read too much into it? Fannie says it will have a “negligible impact” 🤏 on the # of loan apps receiving an approval/eligible recommendation. DU risk recs will not change based on the 3rd party credit scores that lenders may use. Loans sold to Fannie must continue to include a 3rd party credit score per the selling guide.

There are still some basic questions like, umm, how will agencies price these approvals? My guess is they’d price them as 620s. Another question is how will investors respond. One theory that’s been popping up is that this is about getting VantageScore 4.0 up & running. Here’s another one: why are they doing this, & where’s Freddie?

I don’t have any answers yet, but one fun theory posited by Tim Rood (ex-Fannie) is that Trump/Pulte/Bessent could re-IPO one of Fannie or Freddie & use the other to help achieve housing goals. As Rich Swerbinsky points out, “Fannie just named a new CEO, just removed min credit score requirements in DU, been very active in general ... Freddie, much sleepier, no news at all .... 🤔 🤔🤔”

1099 Wake-up Call? 🥱

Broker-owners w/ LOs on 1099s might want to give their attorneys a call. A case out of the 11th Circuit Court clarified the employee v contractor definition.

“The ruling reinstated an overtime case brought by 3 insurance adjusters who had been classified as contractors, holding that a jury could find they were actually employees entitled to FLSA protection. While the case arose outside the mortgage industry, its reasoning has direct implications for lenders & brokers that rely on ‘1099’ loan originators or contract processors,” wrote industry attorney Troy Garris.

The Galarza decision underscores increasing judicial skepticism toward contractor classifications, Garris wrote.

“Key takeaways for mortgage companies:

Labeling is irrelevant. Calling a worker an “independent contractor” will not withstand scrutiny if the relationship functions like employment.

Exclusive or full-time work is risky. Requiring 1099 LOs to work set hours or prohibiting side business can suggest employee status.

Providing tools and systems (e.g., loan origination platforms, leads, or branding) can weigh heavily toward an employer-employee finding.

Control over compensation, such as dictating commissions, pricing, or loan terms, reinforces dependence.

The ruling serves as a wake-up call: courts are looking past contract language to the actual economic relationship. For mortgage firms, that means renewed focus on how compensation, supervision, & exclusivity clauses are structured. A misstep could convert an entire 1099 sales force into employees for FLSA, tax, & state-law purposes, bringing substantial wage-and-hour & regulatory exposure. We leave aside regulatory concerns that can arise if the individuals actually are contractors, and are not suggesting this is a clearly settled area of law.”

Rocket’s New (Old?) Servicing Platform 🦳

Rocket announced in March that it would be moving its servicing portfolio off ICE’s MSP & onto Sagent’s DARA platform. But Rocket is taking a detour along the way. Rocket is using Sagent’s legacy mainframe LSAM system of record while they build DARA. Once DARA’s development is completed, they’ll start end-to-end testing. Rocket expects that to happen in ‘27. LSAMs was a legacy product from Fiserv. Mr. Cooper took a 20% stake in Sagent in ‘22.

Quickies

loanDepot took another loss in Q3 & origination volume was down from Q2, though there are signs of better days ahead. The $8.7M loss was a big improvement y-o-y & Anthony Hsieh said the market remains highly fragmented. "There is a ton of room chasing the leader in the space, so we're very enthusiastic, & we are laser focused to stay on plan, get back into a standard of operations that allows us to be an industry leading mortgage bank," Hsieh said on Loandepot's earnings call. He said the combination of builder biz, JVs, retail & DTC gives LD an edge to scale up & capture volume when rates (hopefully) fall.

Guild, which will soon be part of Bayview, made $33.3M in net income in Q3. The $7.4B in originations were down from Q2 but up y-o-y. Pretty solid quarter for Guild. Per Modex, in recent months they’ve picked up Betsy Lowther (Luminate), Andrea Zundel (Edge), Tyler Brown (PRMG), Jeff Griege (Paramount Bank) but lost Robert Pezzella (G-Rate Affinity), Salvatore D'Elia (Rate), Kellie Clark (CCM).

Rate & term refis as a percentage of first-lien activity climbed to 49.6% in Q3, compared to 28% in Q2, per Ardley.

Stewart announced that an affiliate will acquire Mortgage Contracting Services for $330M. MCS works w/ servicers & lenders to preserve property when borrowers are in default.

ARMchair Critics

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)