From first-time buyers to files full of exceptions, Friday Harbor’s AI Originator Assistant is built for real-world lending. Visit fridayharbor.ai.

Lending Execs Grade Their Vendor Partners 🧑🎓

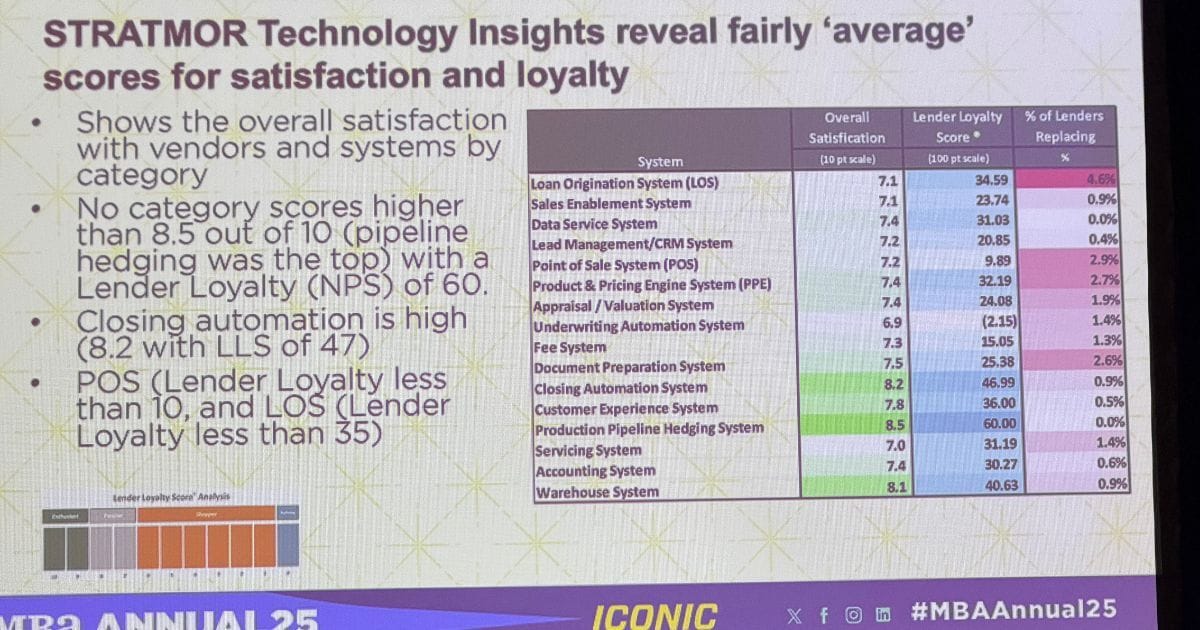

Hedging software is performing well. Underwriting automation systems and servicing platforms? Not so much.

In a recent STRATMOR survey, 300 lending execs gave their vendor partners a “C grade” overall. Not exactly summa cum laude.

“Lenders do not have a significantly high level of satisfaction w/ the vendor stack,” said STRATMOR’s Garth Graham at MBA Annual on Wednesday. The survey contained more than 20 vendor tech stacks & per Graham, it’s all rather complicated. For example: Sometimes a low score for the POS is actually the fault of a poor integration w/ the LOS & PPE.

“Here’s the point: Many times we see dramatically different levels of satisfaction and adoption w/ identical solutions from 2 different lenses,” Graham said. Lenders need to look in the mirror & be introspective about their ability to implement tech, manage it & evaluate the impact. Other factors that could have led to dissatisfaction in the survey included contract terms & minimums, Graham added.

Top marks went to production pipeline hedging, closing automation & warehouse systems. The lowest performers were AUS, POS, LOS 🤯 . Maybe then it’s no surprise that some of the buzziest vendors at Annual were Tidalwave, Friday Harbor & Vesta. (Full disclosure: Friday Harbor is an advertising partner w/ The Scoop.)

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)

What's On Tap - Oct. 23

Vendor Grades (Cont.)

On Wednesday, Boston Consulting’s Dimitrios Lagias ID’d 4 reasons why major tech transformations at lenders sometimes go off track:

Internal investment discipline. Often the business case is too optimistic or not done well. People forget why they started the tech change in the first place.

Change transformation. Imagine what level of change is required and double it, Lagias suggested.

Scope creep. It is another major challenge, w/ delays routinely adding 6-12 months to a project. “One thing that we started doing right now, which is a little bit provocative, is we recommend our clients to start with 2 [vendors] on the same module for a 2-to-3 month period. Every time we've done it we've learned so much about the culture of the vendor, issues we find.”

Business & technology gaps. “Every transformation starts w/ like, ‘Oh, this is going to be business led & technology enabled.’ That's an amazing principle & it fails 7 out of 10 times.”

🍦 Important News About The Scoop 🍦

Hey, everybody! The Mortgage Scoop launched 2 months ago & I’ve been blown away by the support. It was great seeing industry pros at MBA Annual & hearing how much they love The Scoop. Thank you 🙏 so much.

I wanted to share an important update about the business. We’ll be moving to a paywall in November.

Paid subscribers will get exclusive MWF newsletters packed with scoops, analysis & insights you won’t find anywhere else (plus some bonus content). Founding Members can lock in the price for 2 years for $240. Monday editions will remain free for all subscribers. Hit me up w/ any questions you might have. - James Kleimann

Stenger Moves to Rate 📤

At Xactus’s penthouse suite on the 88th floor of the Fontainebleau on Tuesday, Jason Stenger was all smiles. It was his first day at Rate as chief production officer after many years in an ops role at Movement Mortgage, & he was very excited.

Stenger told The Scoop that he’s going to be hitting the road to meet & support Rate sales leaders. He will also help develop the production strategy alongside Rate President Shant Banosian 🐐.

Rate founder & CEO Victor Ciardelli even carved out a new role for Stenger. Stenger is not bumping any sales leaders out & will answer to Shant, sources said.

Charlotte-based Stenger is the rare ops guy who thinks like a producer, so it’s an interesting move for him, particularly given how different the culture is at Rate (it’s pretty hardcore & outside observers said he’ll be under pressure to perform).

Stenger is also not bringing any production w/ him from Movement. “I have the utmost respect for Casey & the team at Movement,” he told The Scoop. “We left on great terms & this was just an incredible opportunity for my career.”

Still, the sales pyramid at Rate is getting ever-more crowded at the top. Often splashy new additions also spur senior-level departures…

If you were struggling to adapt to AI, would you dare tell anyone? While some companies definitely have a plan (UWM, for example) & are making big gains, a good number of industry players appear to be deploying chatbots & well, posturing.

One source at a top tech firm said the technology is typically about 18-36 months ahead of it being operationalized at an enterprise level for lenders. AI has the power to completely reshape the industry, he said. Mid-tier lenders could ascend quite dramatically b/c the tech playing field has been leveled. Conversely, poorly managed large IMBs conversely could see market share erode. It’s really about preparedness & management skill, he said.

So how does one spot who’s really doing the AI work, & who’s just faking it?

“Some companies just want to give LOs gimmicky tools,” said one tech exec. “That’s 1 sign. Another way to tell is their why. If it’s coming from the board, that’s a sign they’re probably not going to get it right.”

There’s a lot of temptation to fake it. It did not go unnoticed that there were reps from top Wall Street consulting firms, private equity shops & VCs roaming the halls of MBA Annual.

At least one prominent mortgage tech exec thinks there’s a straight up bubble in mortgage.

"I don't think you could look at the industry and not think we're in the middle of an AI bubble," NewRez’s Brian Woodring said at a panel on Tuesday.

He pointed to similarities to the dot-com bubble of the 2000s. While there were faux tech companies like Pets.com, actual tech giants did emerge from that period…

Peace Out, Priscilla 🕊

Fannie Mae CEO Priscilla Almodovar is leaving the GSE & will be replaced by Peter Akwaboah as acting CEO. John Roscoe & Brandon Hamara have been promoted to serve as co-presidents.

D.C. sources say Pulte never was tight w/ Almodovar, a Biden appointee, like he is w/ Freddie counterpart Mike Hutchins. “She actually stuck around much longer than most of us expected,” said one federal housing source, who added that Almodovar didn’t have a great relationship w/ the industry.

Akwaboah is an experienced leader & should be able to transition pretty easily. More interesting is the rise of Roscoe (a protege of Mark Calabria) & Hamara, a 30-something homebuilding exec at Tri Pointe. They’re seen in DC as “Pulte’s guys,” one insider said.

FWIW, there was disappointment in Vegas that none of the top brass at Fannie, Freddie or FHFA appeared at MBA Annual but it’s kinda to be expected at this point.

Vegas Dispatches 🎲

The vibe at Annual was optimistic. Lenders & servicers feel positive about the upcoming year, & while the vendor space is crowded, there is some definite innovation coming. Not a lot of deals were inked, but vendors said lenders seem more interested in changing their list of partners than they had been since pre-pandemic. “The value & beauty of relationship building is back,” said one attendee.

Re mortgage fraud: Compliance/fraud lawyer Bob Simpson posed a simple question: How many LOs know their clients intend to commit occupancy fraud but look the other way? 🤔

Marina Walsh celebrated her 25th anniversary at the MBA. Congrats to Marina!

There’s been a rise in retail LOs moving over to credit unions, a few sources said.

The MBA had a bunch of standing room-only sessions on AI, including one where people vibe-coded. Julian Hebron’s live tech demos were also well received.

The Scoop’s favorite MBA Annual swag was probably this sweet t-shirt from MSuite.

Other faves included Floify’s dope fanny pack & Mortgage Cadence’s hand sanitizer. Guys, no more keychains. The best stuff is practical. How about a glasses case? Or maybe a Jigsaw puzzle depicting you solving the most vexing challenges in compliance & document management?

Matthew VanFossen of Absolute Home Mortgage/The Big Point of Sale (Big POS) had the coolest LCD backpack I’ve ever seen. It doesn’t top the Nintendo Emulator from last year but VanFossen IMO is a brilliant marketer. The Scoop also hears The Big POS is gaining ground in the POS space…

Wanna buy a software company? Alan Bercovits’s The Complete 1003 software is on the block. The software trains & assists loan officers to “truly bring underwriting to the point of origination.” He is looking to sell an 80% stake.

Truework, which was acquired by Checkr a few months back, is flashing some cash. The VOIE firm gave all registered guests who stayed at the venue’s hotel a $20 credit for food/drink. (That was almost enough to buy 2 bottles of water.)

When some zig, it makes sense to zag. PPE LoanPASS is zagging a bit. They’re building up business in the non-QM space, which is growing & isn’t as much of a focus for its rivals, prez Michael Lewis told The Scoop.

BTW, The Scoop is headed to Nashville, where there’s already broker drama w/ the BAC not being invited to FUSE this year. We’ll have another edition on Friday.

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)