Friday Harbor’s AI Originator Assistant is trusted by leading lenders including APM, PRMG, First Community Mortgage, First Option Mortgage, and dozens of others. Visit fridayharbor.ai for a demo.

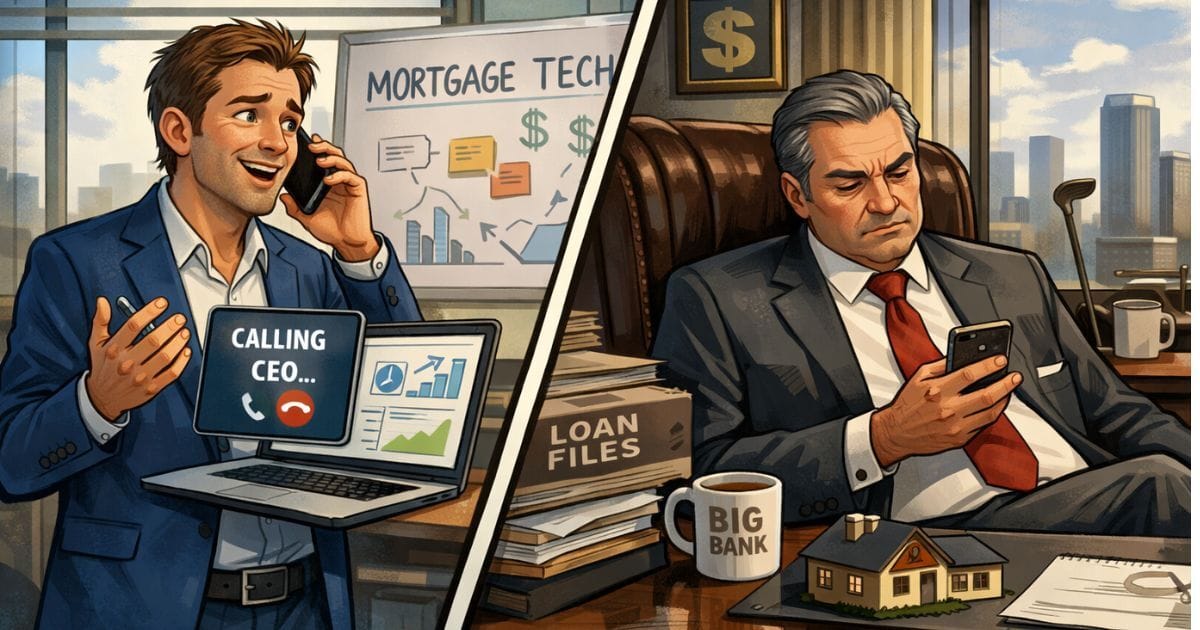

Most lenders would rather have a root canal than find new vendors.

Even with 300+ lender clients, tens of millions spent on R&D & a track record of 1M+ transactions a year, some lenders believe that Brian Zitin’s team is too young & not knowledgable enough to win their business.

“They would rather stick with the old legacy incumbent despite their platform not improving for the last 5-10 years,” said Zitin, who co-founded appraisal tech firm Reggora in ‘17 as a college student.

Zitin & his team spent years refining the implementation process & gaming out millions of edge case scenarios—retail, consumer direct, wholesale. Lenders who want to do appraisal this way vs that way. Lenders on Encompass vs lenders with their own LOS, etc. It’s a dizzying amount of variables.

“This is just one of the many reasons that make building a large mortgage technology company very difficult,” he said.

In today’s edition of The Scoop, we’re bringing you fresh insights from tech executives & lending executives to answer:

1) Why it’s relatively rare for lenders to say goodbye to incumbent vendors

2) How a vendor can overcome that paradigm & thrive

(🙏 If you like what you’re reading, tell a fellow mortgage junkie to sign up here.)

What's On Tap - Jan. 9

Rates are Under 6%—But How Long Will it Last?

QE is back, baby! Kinda! Sorta! President Trump said Thursday that Fannie & Freddie will purchase an additional $200B in MBS, tightening spreads & lowering mortgage rates. It’s already had a measurable impact in just 21 hours—mortgage rates currently have a 5 handle (5.99% per Mortgage News Daily). But this sadly isn’t sustainable.

“If the idea is simply to commit the GSEs to buying $200B in agency MBS, they'll bring in spreads 20, 25 bps or so for the brief period during which they're buying MBS only to see them widen back out to where they are now the moment they stop, leaving us back where we are now & the GSEs either without any capital or $200B in debt,” said Jim Parrott, who recently co-authored a paper on the MBS market & its lack of a buyer of last resort as a stabilizing force.

“So in and of itself it doesn’t seem like smart policy (surely it would make more sense to spend the $200B on new supply). But the most significant piece of all this may just be that Trump has decided to use the GSEs as a policy instrument—and who knows where that goes.”

These moves also don’t happen in a vacuum. The increase in buyer demand from lower mortgage rates will likely put upward pressure on home prices, offsetting some of the affordability.

Still, it does appear to be a short-term win for LOs during the Slow Season, especially those w/ refis in their books. Check out Mike Simonsen’s excellent post, which illustrates how much opportunity has slowly emerged since the 2% COVID days.

Courtesy of Mike Simonsen

What the GSEs are doing isn’t even new, per se. Fannie & Freddie have already retained about $70B in mortgages since May to bring down spreads. If they were to add another $200B in MBS, it would also put them near their $450B legal limit. They can’t get around the cap w/o an act of Congress.

I think it’s telling that there’s apparently no consideration to have Treasury purchase MBS again or lower G fees/LLPAs (that went quiet, huh?). This appears to be a headline-grabbing move ahead of Midterms that doesn’t fundamentally change things. I know it sounds like a huge number, but $200B in MBS is a drop of water in the ocean.

The biggest structural problem remains inventory. Here’s one idea from Dusty Lloyd (which came on the heels of the plan to stop institutional investors from buying single-family homes):

What we need is to release some inventory.

Step 1 - Give companies that own over 20 rental properties to have a Capital Gains holiday if they list in the next 6 months and sell in the next 18 months. This will get homes on the market and give an expiration date for the program.

Step 2- Increase demand. Have Congress implement a national Mortgage Credit Certificate. The MCC program was released in the 80's and is a mish-mash of state programs that allow FTHB to get up to 20% of their mortgage interest as a Refundable Tax Credit.

Finally, AI that handles the hard stuff. Friday Harbor helps lenders clear conditions before they exist. See how it works.

The Scoop Insider: Here’s What You Get🍦

Weekly deep dives, scoops, exclusive interviews, insider breakdowns & AMAs

2Y rate lock

Early & discounted access to events

If you’ve been reading The Scoop, you already know what you’re getting: real reporting, deep sourcing, & stories nobody else in mortgage media is touching. We’ve exposed shady lender tactics, examined ICE’s hate-love relationship w/ mortgage, broken dozens of tech stories, dug into UWM’s correspondent play, Rocket’s retail strategy & much more… Insiders get the full Monday/Wednesday/Friday edition—scoops, analysis, sourcing, & context you will not find anywhere else—plus early access to new features.

If you rely on The Scoop to stay sharp, informed, & ahead, this is your chance to support independent, scoop-driven mortgage journalism. Insiders pay $275 a year ($22 a month). Sign up for a 2-week free trial today.

Mortgage Thoughts on Compass-Anywhere Merger 🤔

Now might be time to cozy up to your local Compass* agents. Regulators have given Robert Reffkin their blessing to buy Anywhere for $1.6B. (Per the WSJ, Compass hired Trump-aligned lawyer Mike Davis to go over the heads of DOJ antitrust leaders to squelch an investigation. Deputy AG Todd Blanche agreed to greenlight the deal. So if you’re a mortgage executive looking to pull an ICE-Black Knight, Mike Davis is the guy to call.)

Compass will have somewhere around 20% market share nationally, but they’re going to absolutely effing dominate 💪 some big markets. Per an analysis of RealTrends data by The Capitol Forum, a combined Compass-Anywhere brokerage would have a market share of roughly:

Los Angeles: 40%

Raleigh: 46%

Houston: More than 50%

Austin: More than 50%

Honolulu: 54%

Seattle: 57%

Denver: 60%

Boulder: 60%

Brooklyn: Over 60%

Washington D.C.: Over 60%

Boston: Over 60%

San Francisco: 64-65%

Nashville: Close to 70%

Newport Beach, California: Over 80% Manhattan: Over 80%

On the lending side, b/c Compass & Anywhere agents tend to be luxury focused, their clients get a higher share of mortgages from big depository banks. Both brokerages have JVs w/ Rate (OriginPoint, Proper Rate & Guaranteed Rate Affinity), and, as The Scoop previously reported, will consolidate under the Guaranteed Rate Affinity banner.

Overcoming ‘Brutal’ Mortgage Tech Odds 🔒 (Cont.)

One of the biggest barriers is that many lenders can't actually implement new technology well, Zitin said. Tech implementations often go wrong even if the product is good. Deadlines are frequently missed and it’s “a nightmare to get stood up.”

The reality is that user acquisition & adoption in mortgage is “brutal, full stop,” said Thomas Seelbinder, who leads product at mortgage & real estate intelligence platform ModelMatch. “Compared to other industries I’ve worked in, the acquisition and adoption rates that are considered ‘normal’ were a real shock,” he said. “It’s not a problem you solve once. It demands constant evolution.”

This is our first story in the new Vendor Wars series, which opens up the playbooks of vendors across the mortgage ecosystem. To read more, become a Mortgage Scoop Insider. And if you’re interested in sponsoring the series, reach out to me at [email protected].

Subscribe to The Mortgage Scoop Insider to read the rest.

Upgrade to The Mortgage Scoop Insider to get access to this post and other subscriber-only content.

UpgradeA paid subscription gets you:

- Weekly deep-dives

- Exclusive interviews

- Insider breakdowns